Payroll & HR Built for Facility/ Community-Based Care

The #1 Choice for SNF, AL, and Senior Living

Payroll admins at SNF, AL, and senior living facilities face numerous unique challenges, from complex PTO setups, payroll across multiple facilities, calculating shift differentials, and blended rates, to managing retroactive pay, multi-rate overtime, and tax calculations. In such a demanding environment, having a dedicated payroll and HR partner like Viventium makes all the difference.

Viventium’s end-to-end platform provides a flexible approach:

-

Complex compliance: Navigate intricate industry-specific labor laws, regulations, and ever-changing compliance requirements, reducing your risk of penalties and fines.

-

Payroll accuracy: Manage retroactive pay, multi-rate overtime, and tax calculations faster, easier, and with precision.

-

Staffing shortages: Our ATS and Onboarding solutions help you streamline your recruitment process, reducing the time-to-fill.

-

Reduce turnover rates: Viventium offers a great onboarding experience, consistent pay transparency, and autonomy through Employee Self Service (ESS) to help you retain caregivers and staff.

-

Technology adoption: With tools designed for caregivers via ESS, Viventium bolsters employee engagement and provides greater transparency into insights.

Schedule a call to learn why Viventium is the leader in facility/community-based payroll and HR.

Payroll & HR Built for Facility/ Community-Based Care

The #1 Choice for SNF, AL, and Senior Living

Payroll admins at SNF, AL, and senior living facilities face numerous unique challenges, from complex PTO setups, payroll across multiple facilities, calculating shift differentials, and blended rates, to managing retroactive pay, multi-rate overtime, and tax calculations. In such a demanding environment, having a dedicated payroll and HR partner like Viventium makes all the difference.

Viventium’s end-to-end platform provides a flexible approach:

-

Complex compliance: Navigate intricate industry-specific labor laws, regulations, and ever-changing compliance requirements, reducing your risk of penalties and fines.

-

Payroll accuracy: Manage retroactive pay, multi-rate overtime, and tax calculations faster, easier, and with precision.

-

Staffing shortages: Our ATS and Onboarding solutions help you streamline your recruitment process, reducing the time-to-fill.

-

Reduce turnover rates: Viventium offers a great onboarding experience, consistent pay transparency, and autonomy through Employee Self Service (ESS) to help you retain caregivers and staff.

-

Technology adoption: With tools designed for caregivers via ESS, Viventium bolsters employee engagement and provides greater transparency into insights.

Schedule a call to learn why Viventium is the leader in facility/community-based payroll and HR.

Award-winning platform

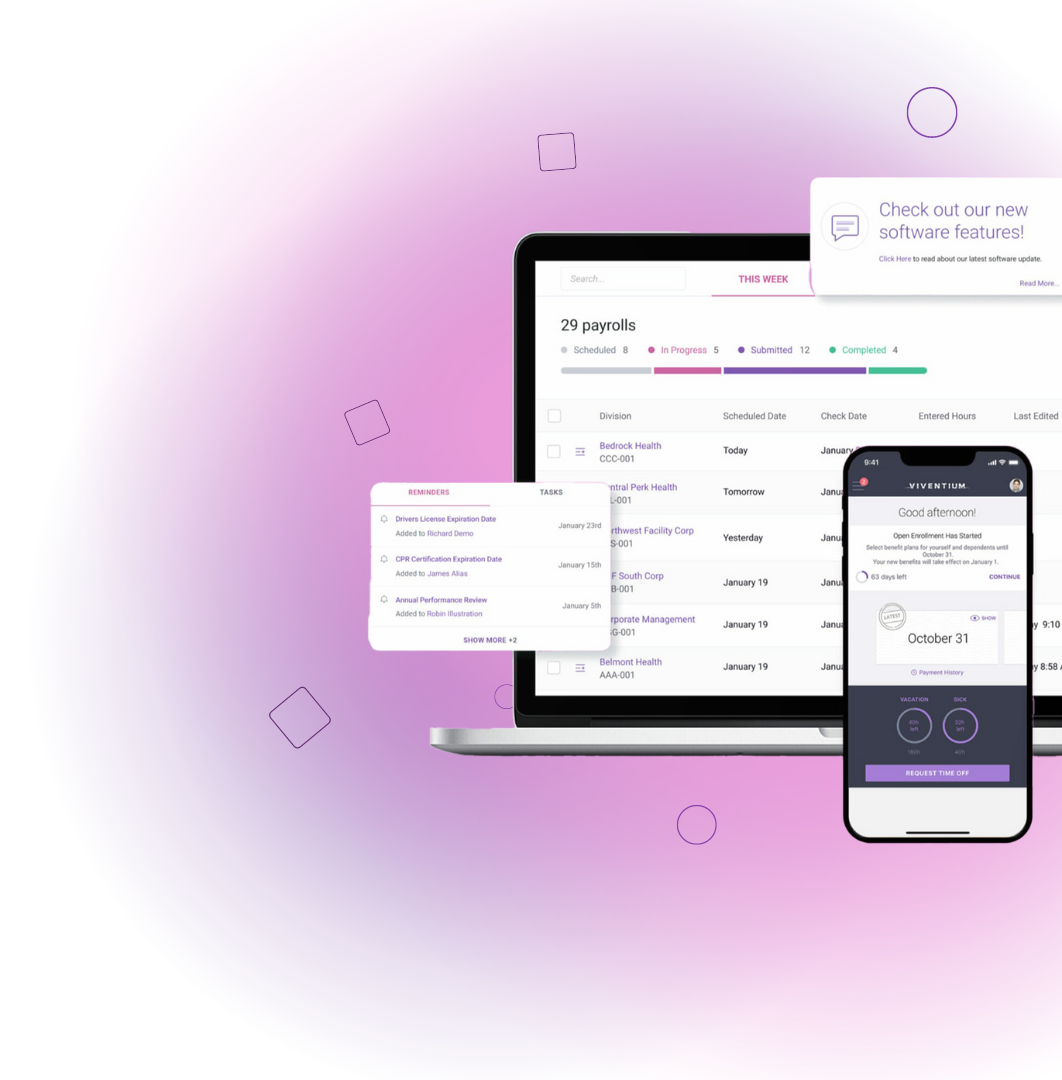

Flexible Software

Streamline processes, automate complex payroll calculations, and empower administrators with intuitive and easy-to-use technology.

Expert Guidance

Our team is made up of facility/community-based care veterans offering expert payroll and HR guidance to improve operations and ensure compliance.

Caregiver Centric

We built the Viventium platform around the caregiver experience to promote retention, transparency, accessibility, and engagement.

Streamline processes, automate complex payroll calculations, and empower administrators with intuitive and easy-to-use technology.

Our team is made up of facility/community-based care veterans offering expert payroll and HR guidance to improve operations and ensure compliance.

We built the Viventium platform around the caregiver experience to promote retention, transparency, accessibility, and engagement.

Why Clients ♥ Viventium

"The addition of Viventium’s Benefits Administration module to our product suite has been amazing. We were able to cut almost all of the manual work out of our open enrollment process, giving our HR team much-needed time back into their day."

United Living Community

"Viventium’s commitment to their clients has exceeded our expectations. The team from Sales to Client Service provides excellent support, and we know when we have the occasional payroll emergency, we can count on the relationship we have built over the years. We are confident that Viventium will continue to help us maximize use of the software and provide a great partnership as we grow."

Isaac Soussan

Honor Health Network

Feature Highlights

- Retroactive pay & overtime

- Geo-tax location

- Third-party files and Payroll-Based Journal (PBJ)

- Global search

- Shift differentials, overtime premium, and blended rates

- Complex PTO set ups

- Business intelligence

- Third-party imports

- Employee self service

- Union tracking

- Custom pay stubs

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

Calculate your net or “take-home” pay here. Take-home pay is what is left over from your wages after withholdings for taxes and deductions for benefits have been taken out. Salaried employees can enter either their annual salary or earnings per pay period.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

The Flat Bonus Calculator uses supplemental tax rates to calculate withholdings on special wage payments like bonuses. If your state does not have a special supplemental rate, you will be redirected to the aggregate bonus calculator. This is state-by-state compliant for those states who allow the aggregate method or percent method of bonus calculations.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

This tool will take you step-by-step through the process of filling out a Form W-4. The Form W-4 determines how much of your pay is withheld to pay federal, and in some cases, state and local taxes. At the last step, you will even be able to print an official copy to give to the payroll department at your company.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

The Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments, such as bonuses. This is state-by-state compliant for those states that allow the aggregate method or percent method of bonus calculations.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

Here you can calculate take-home pay based on up to six different hourly pay rates that you enter. This is the perfect solution for those who are paid on a changing hourly basis.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

The 401(k) calculator helps you plan for your future. Your 401(k) plan account might be your best tool for creating a secure retirement. Why? You only pay taxes on contributions and earnings when the money is withdrawn. Plus, many employers provide matching contributions. Use this calculator to see how increasing your contributions to a 401(k) can affect your paycheck and your retirement savings.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

The Gross-up Calculator helps you determine the amount of gross wages before taxes and deductions are withheld, given a specific take-home pay amount.

.png?width=97&height=96&name=Span%20%5Bblock%5D%20(9).png)

Want to talk more about Payroll Calculations?

Tools Designed for Facility/Community-Based Care

Payroll

Employee Self Service

Onboarding

Business Intelligence

Affordable Care Act (ACA)

Time & Attendance

Applicant Tracking

Human Resources

Task Management

Benefits Administration

Employee Pay Options

Learning Management

With Viventium, facility/community-based care admins navigate industry complexities with confidence, knowing they have a trusted partner dedicated to their success.

With Viventium, facility/community-based care admins navigate industry complexities with confidence, knowing they have a trusted partner dedicated to their success.

You Might Also Like...

.png?width=800&height=400&name=The%202025%20Healthcare%20Workforce%20Management%20Report%20(12).png)

White Papers

White Papers

Skilled Nursing