Register Now to View On Demand

Breaking news: Federal court cancels the DOL's new overtime rule.

Year-end 2024: The IRS’s reduction of its threshold for mandatory electronic filing of Forms W-2, 1099, and 1095 started in 2023 and continues to impact your filing this year.

January 1, 2025: The much-touted DOL rule increasing the number of employees you potentially need to pay overtime to has been cancelled. And what's more -- the current DOL rule which took effect on July 1, 2024, and potentially caused you to pay overtime to many more workers has also been cancelled.

Do you and your payroll team understand the implications of these two major threshold changes and the latest court ruling?

Join Viventium’s veteran compliance expert, Yonina F. Shineweather, CPA, to find out how these changes may impact you in just a matter of weeks and in fact may be impacting you already.

You’ll learn:

- What the e-filing “combined total of 10” means;

- Which steps you need to take today to ensure year-end compliance;

- Who/what IRIS is and how to choose the IRIS method that’s best for you;

- To whom you may need to start paying overtime (or increase their salary); and

- What’s planned for future threshold increases.

View On Demand

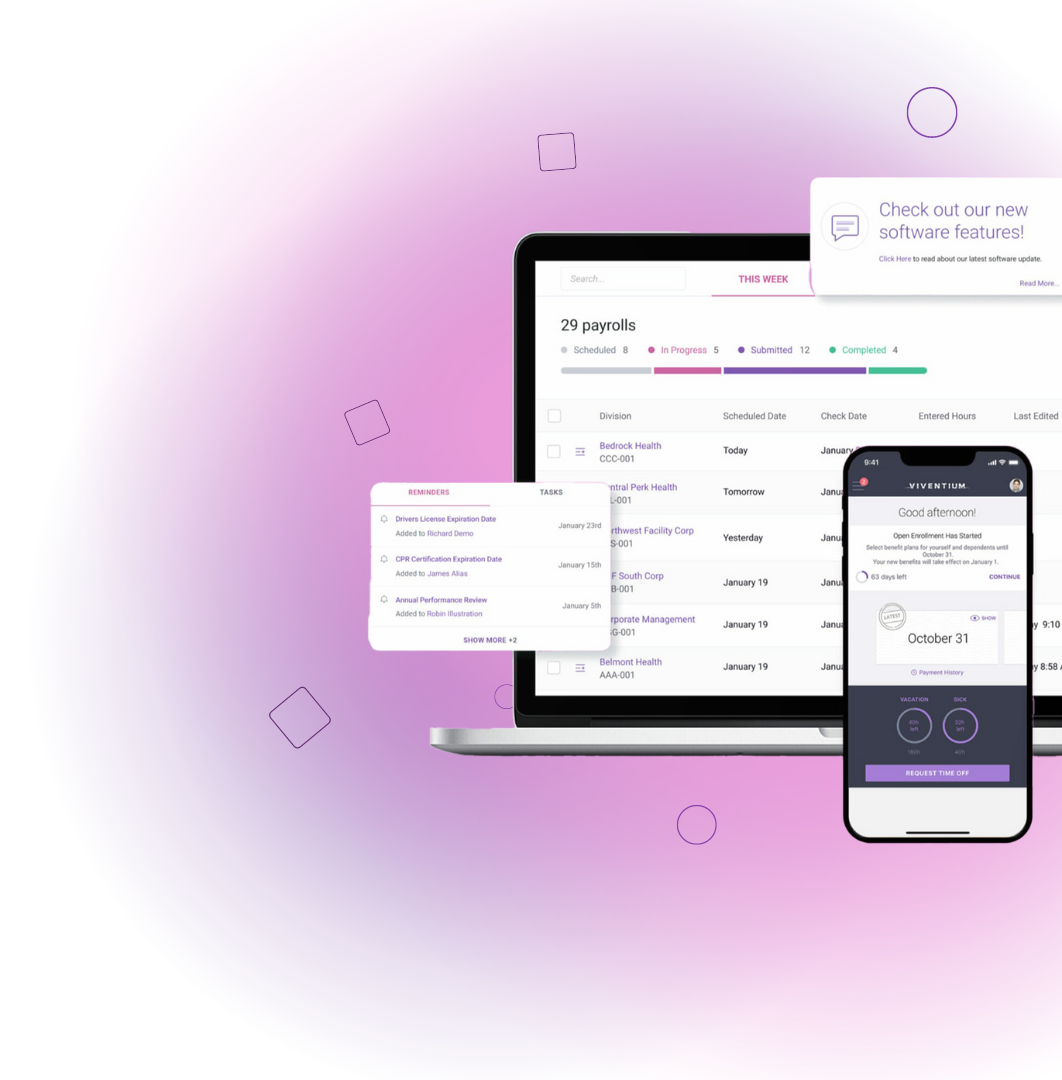

Rest assured, Viventium is here to support you in all things HR

With Viventium, admins in the health services industry know they have a trusted partner dedicated to their success.

In it with you, always.